In the dynamic finance industry, reskilling is not an option but a necessity. Staying competitive and informed empowers individuals to make better decisions for the organization. Are you planning to reskill yourself this season? If yes, then you must consider the Financial Modelling Courses from the CFI Education.

We provide accredited online courses, in-demand certifications, and productivity-boosting tools and resources to our students so that they can upskill themselves and drive their careers in Banking and Finance.

Why is a Financial Modelling Course Crucial in Today's Scenario?

The Financial Modelling & Valuation Course provides valuable tools and knowledge to students that are necessary for decision-making, securing funding, and making strategic decisions.

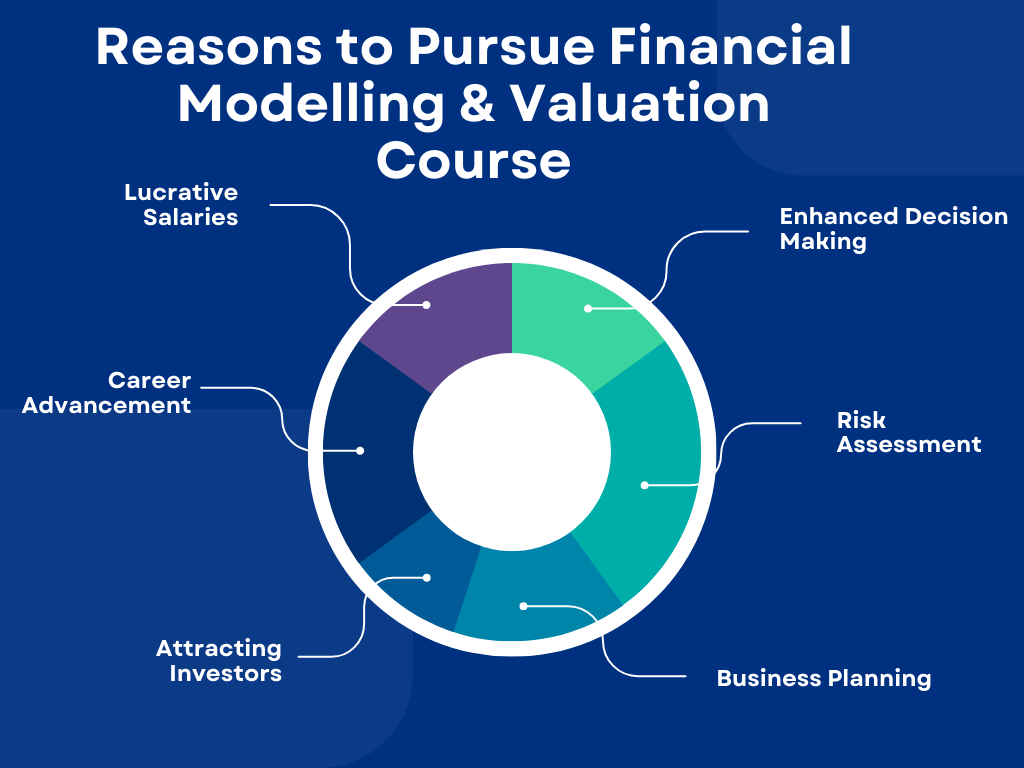

The other added benefits of pursuing a Financial Modelling & Valuation Course are-

1. Enhanced Decision-Making

Financial Modelling & Valuation Course enhances the decision-making abilities of the learners. The Financial models help in evaluating the financial health of the company. They also help in making informed decisions regarding investments, resource allocation, and expansion.2. Risk Assessment

Financial Modelling & Valuation Course also teaches learners how to evaluate the underlying challenges and how to mitigate them.3. Business Planning and Identifying Potential Areas for Growth

The Financial Modelling Course provides a roadmap for achieving financial goals. It also helps in identifying the potential areas where a business can progress. The Financial models will help you to evaluate the quantity of assets required and the ways to amplify profitability.4. Attracting Potential Investors

It is easy to secure funding when the business is financially sound and profitable. Financial Analysts help in mitigating financial risks and improving profitability. Enhancing the financial stability of the organization will elevate your investment prospects.5. Career Advancement

The Financial Modelling & Valuation course will unlock doors to various opportunities. You will become a valuable asset to the organization after the course. The chances of holding prestigious positions will also increase. Some of the positions are Financial Analyst, Business Analyst, Credit Analyst, Merger and Acquisition Associate, and Equity Research Analyst or Associate.6. Personal Finance Management

The Financial Modelling & Valuation course will enhance your asset allocation, budgeting, and expense management. You will become far more equipped to make financially conscious decisions in life.7. Enhances Entrepreneurial Success

When you deeply understand the perfect balance between asset allocation, expenditure management, and budgeting, you know how to run a business financially.8. Lucrative Salaries

There is no doubt that careers in finance, medicine, and technology are financially rewarding. The entry-level salary for a Financial Modeling Analyst is between 5 to 8 LPA. The salary for a mid-level Financial Modeling Analyst is between 8 to 15 LPA whereas the salary for a senior-level Financial Modeling Analyst is between 15 to 35 LPA.From Where Should I Pursue the Financial Modeling & Valuation Course?

After learning about all the benefits of the Financial Modeling & Valuation Course, you may be wondering where to pursue it.Corporate Finance Institute (CFI) was founded in 2013 to provide world-class finance education. We have an experience of more than seven years and have trained more than 5,000 professionals. We also provide courses like CFA Level 1, Data Analysis using MS Excel, Investment Banking Program, and FMI Certification.

The other added benefits of pursuing our Financial Modeling & Valuation course are-