FMI Certification

The World’s Financial Modeling Certifications

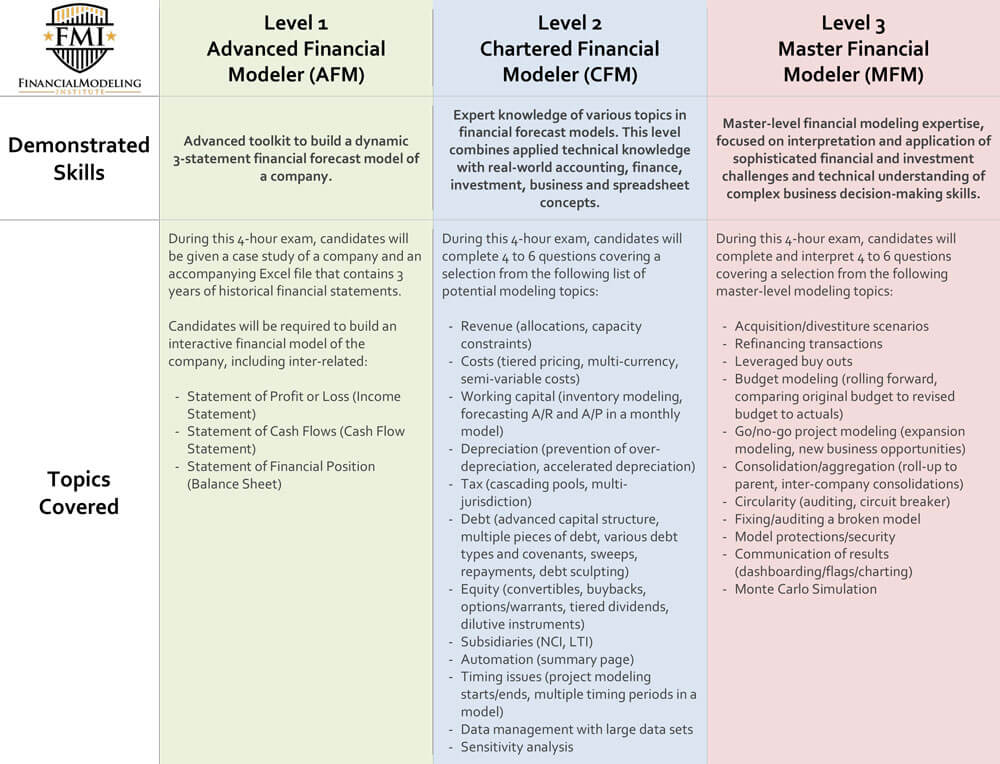

The Financial Modeling Certifications are an internationally recognized credential for advanced Microsoft Excel, financial analysis and financial modeling skills. The FMI offers three levels of certification, gradually increasing in difficulty as candidates obtain each subsequent level: Advanced Financial Modeler (AFM); Chartered Financial Modeler (CFM); and Master Financial Modeler (MFM). Each level is recognized as its own qualification.

Level 1

Advanced Financial Modeler (AFM)

Level 2

Chartered Financial Modeler (CFM)

Level 3

Master Financial Modeler (MFM)

FMI Level Matrix

The AFM Exam

The AFM exam provides participants with a unique opportunity to demonstrate their modeling proficiency through an intensive modeling exam within a controlled environment. Participants who pass the exam will achieve the Advanced Financial Modeler credential.

Why Earn the AFM Certification?

The AFM is the foundational level for earning the most respected financial modeling certification in the industry. It sets the global standard in financial modeling proficiency and allows you to differentiate yourself in an increasingly competitive financial environment. Consider how obtaining the AFM can accelerate your career:

• Skill Validation: Demonstrate advanced financial modeling proficiency to yourself and employers.

• Personal Development: Invest in yourself by earning certifications that are challenging and revered by the industry.

• Career Flexibility: Obtain a skillset that is globally relevant and respected across multiple lines of business.

Candidate Profile

The AFM program is open to anyone who has an interest in or currently works in the financial markets. From finance students to seasoned industry professionals, the AFM designation is ideal for those who:

• Understand the fundamentals and methodologies of financial modeling

• Want to hone and validate their skills.

• Work as part of a larger team to provide support for improvement or new projects.

• Work extensively with Excel in their day-to-day work to make material financial decisions.

Level 1 Content Overview – Foundational Skills

• Financial model layout and best practices

• Intermediate-to-advanced Microsoft Excel skills

• Excel efficiency

• Scenarios Analysis

• Accounting fundamentals including financial statement construction and linkages

• Model schedules (e.g. Fixed vs Variable Costs, Working Capital, Deferred Taxes, Debt, and Equity)

Candidate Journey

The AFM certification is open to anyone with an interest in financial modeling. There are no work experience or education requirements and the exams are offered twice a year. Read the Candidate Journey to understand study techniques, exam day, and your options after successfully earning the certification.

Before registering for your AFM exam, please ensure you take the time to understand the following:

• Choose Exam Date: Exams are held two times per year in April and October. The next exam date is October 19, 2019

• Select Exam Location: View the global testing centre locations here.

• Exam Fee: Exam fees are based on the city in which you will sit your exam. See the full list of exam fees here. Student discounts are available.

The AFM exam is based on self-study exam with individuals typically devoting between 25 and 100 hours to prepare, depending on their level of modeling experience. The FMI would recommend candidates undertake the following activities:

• Review the AFM Body of Knowledge >>

• Take a financial modeling course from a reputable provider

• Ensure a strong working knowledge of Excel

• Understand accounting concepts including the interaction between the income statement, cash flow statement and balance sheet

• Assess your exam readiness using the Skills Checklist >>

• Practice with a variety of Sample Exam Models >>

• Manage your preparation with the Level 1 Study Guide >>

• Accelerate your learning with FMI Approved Training Providers >>

• Get ready for your Level 1 Exam with upcoming Training Courses >>

• 4-hour exam held at global testing centers

• The next exam date is October 19, 2019

• All exams are in English

• You will be required to bring a valid piece of government-issued photo identification to the testing center on exam day (e.g. passport or driver license)

• Further details about the FMI exam day policies can be found in our FAQ Section.

Results are mailed to candidates within 10 weeks of the exam. Should you need to re-sit the exam the Re-Take Fee is US$200 (or equivalent in your local currency). This fee covers the administration, facility rental and grading required for the exam.

Once a candidate passes the exam, they may use the AFM designation:

• After their full name in written correspondence and/or as part of your email signature.

• After their full name on business cards, letterheads and/or name plates.

• As an identifier in resumes, curriculum vitae, biographies, personal statements and/or published articles.

After successful completion of Level 1, candidates can elect to progress to Level 2 – Chartered Financial Modeler.

Students Speak